The Ins and Outs of Unemployment Benefits in Maryland

The Ins and Outs of Unemployment Benefits in Maryland

It’s not news to anyone that the novel coronavirus and COVID-19, have taken a toll on just about every facet of society across the globe. From overwhelming healthcare systems to shutting down schools and whole cities- this public health crisis has been extremely difficult and challenging. Our economy has certainly not been spared from the virus’ unforgiving path of destruction. Thanks to lockdowns, “non-essential” businesses have been forced to close, with no end date in sight for many. While the CARES Act did provide some relief for employers struggling to meet their financial obligations, it was not enough to temper the wave of unemployment claims that has battered states and the federal government for weeks now.

Since March 14, 2020, the Maryland Department of Labor has reported 344,387 first-time unemployment claims. For the week of April 18th alone, the Department of Labor reported 47,545 unemployment claims. This is in stark comparison to an average of 2,592 new unemployment claims per week between the end of December 2019 and March 7, 2020. With this huge jump in claims, Maryland’s claims application site has struggled to keep up with the added traffic.

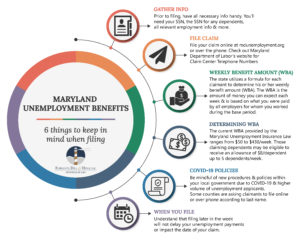

With so many of the unemployment applications coming from first-timers, we thought it might be useful to provide a quick tutorial of some of the basics of filing for unemployment. How do you file? What can you expect in the way of benefits? Can you also receive benefits from the federal government? Read on to find out the answers to these questions, and don’t forget: you can always send us your own questions!

How do I file for Unemployment?

According to the Maryland Department of Labor, if you are unemployed or working part-time, you should file your claim as soon as possible. Your eligibility to receive unemployment benefits from the state cannot be determined until you actually file. Your eligibility then becomes active the week you file your claim (usually by the following Sunday).

You’ll need to make sure you have several pieces of information handy prior to starting your claim application. Along with knowing your name, address and phone number, you’ll also need:

- Social Security Number;

- Names, birth dates and SSN of any dependents you’re claiming;

- Name, payroll address, phone number and reason for separating from any employer you worked for in the 18 months prior to filing your claim;

- If you are not a U.S. citizen, proof of your alien status;

- If you were in the military in the 18 months prior to filing, your DD214, Member 4; and

- If you worked for the federal government, your Form-50 or SF-8 if available

You have several methods to file your claim. You can file online at mdunemployment.org or over the phone. For a list of phone numbers, check out the Claim Center Telephone Numbers site on the Department of Labor’s website.

What Benefits can I Expect?

The state utilizes a formula for each claimant to determine his or her weekly benefit amount (WBA). The WBA is the amount of money you can expect each week and is based on what you were paid by all employers for whom you worked during the base period. Maryland utilizes two types of base periods to help determine a claimants WBA: standard and alternate:

- Standard Base Period: this is the first four of the last five quarters completed before you filed your unemployment claim. If you worked full-time during all four quarters, your WBA will be roughly half of your gross weekly wage up to the maximum WBA for the state. You must have earnings in two of the four quarters of the base period.

- Alternate Base Period: if you are not monetarily eligible to receive benefits under the Standard Based Period, then an Alternate Base Period will be automatically considered for potential monetary eligibility. The Alternate Base Period uses the four most recently completed quarters to determine your WBA.

In general, the higher your earnings, the higher your WBA up to the maximum allowed by law. The current WBA provided by the Maryland Unemployment Insurance Law ranges from a minimum of $50 to a maximum of $430 a week. For those claiming dependents on their unemployment application, you may be eligible to receive an allowance of $8 per dependent up to 5 dependents per week. For unemployment purposes, a dependent is defined as a son/daughter, stepson/stepdaughter, or legally adopted child under 16 years of age. Grandchildren and foster children are not considered dependents. Dependents’ allowance will only be paid for 26 weeks during a one-year period. Only one parent may claim a dependent during the one-year period. The dependents’ allowance is factored into the WBA, which will not exceed $430 from the state.

The Federal Pandemic Unemployment Compensation (FPUC) Program

Many claimants have been concerned that unemployment benefits provided by the state, even at their max, will not be enough to help them cover basic necessities. The federal government heard these concerns. With the passing of the CARES Act, came a bump in benefits to those who found themselves suddenly without work.

Embedded in the legislation were plans for a federal aid program designed to provide unemployment benefits conjointly with state programs. With FPUC in place, unemployed claimants can receive an additional $600 per week from the federal government. FPUC will be automatically paid if you receive your normal unemployment insurance benefits and will be paid as a separate payment at the same time as your other unemployment benefits. FPUC is payable for weeks claimed to begin Sunday, March 29, 2020, through the week ending July 25,

Local Governments Implement Changes

It’s important to stay up-to-date on changes that your local governments may be implementing in order to handle the influx of unemployment claims. Not only on a state level, but on a county level as well.

One such example we’re seeing here in Southern Maryland is coming out of Calvert County. Unemployment claimants are encouraged to file according to a new system, which has been designed to make the process easier for claimants. Calvert County residents who need to file a regular unemployment claim online or over the phone are now being asked to file according to his or her last name:

- If your last name starts with A-F, file your claim on a Monday;

- If your last name starts with G-N, file your claim on a Tuesday

- If your last name starts with O-Z, file your claim on a Wednesday.

Residents are reminded that filing later in the week will not delay their unemployment payments or impact the date of their claim. Additionally, filing is open to all by phone on Thursdays and Fridays as well as online for all Thursdays through Sundays. Claim center phone hours have been extended from 7 a.m. to 6 p.m. Monday through Friday and the online NetClaims application is available 24/7 (though you should try to file during slower hours, typically 8 p.m. to 7 a.m., for faster processing).

To contact a center, please call 410-949-0022. Claims may only be filed by phone or online, not by email. You should only reach out via email if you are having difficulty getting through on the phone or accessing the website. If that happens, email ui.inquiry@maryland.gov.

For more information on COVID-19 business resources in Calvert County, visit our resource center at https://www.ecalvert.com/298/COVID-19-Response-and-Resources2020.

Let us Help!

Do you still have lingering questions regarding unemployment benefits in Maryland or from the federal government? Let us help! The Employment Law attorneys at Ferrante, Dill & Hisle, LLC are standing by, ready to help! Give them a call at (410) 535-6100 or send them an email to info@ferrantedill.com.

Disclaimer!

This blog post that is published by Ferrante & Dill is only available for informational purposes and should not be considered legal advice. By viewing these blog posts, the reader understands there is no attorney-client relationship between the blog publisher and the reader. The blog post should not be used as a substitute for legal advice from a licensed professional attorney, and we recommend readers to consult their own legal counsel on any specific legal questions concerning a specific situation.